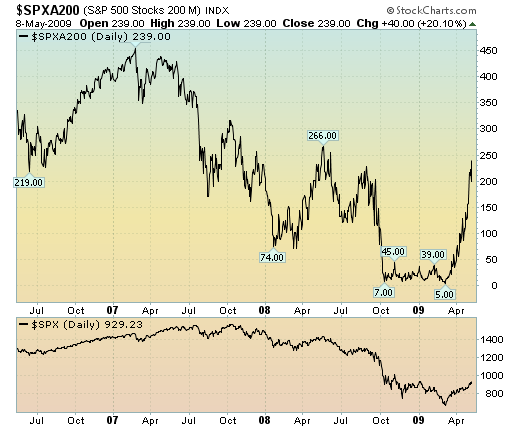

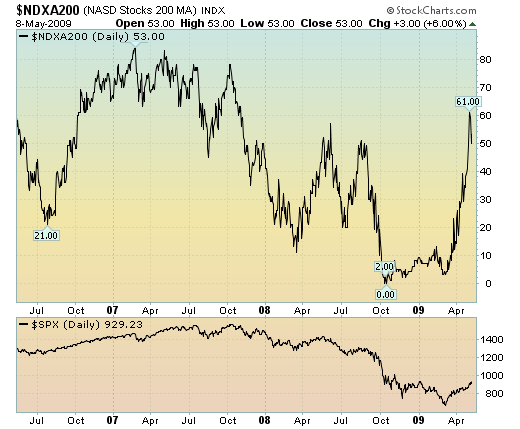

Stocks Above 200 Day Moving Average

Typically, I use the number of stocks above their 50-day moving average, but this time it didn’t work as a short signal. I’m guessing that’s because most 50ma’s were very low after a long and severe drop we had.

Take a look at the number of stocks that are currently above their 200dma. Fairly high. Not extreme if you think we’re in a new bull market.

However if you think this is a bear market rally, as I do, then this market is very overbought. These indicators are at the same levels as they were at the peak of 2 big 2008 rallies; $NDXA200 is even higher.