How Not To Do Covered Calls

[[SRS]]

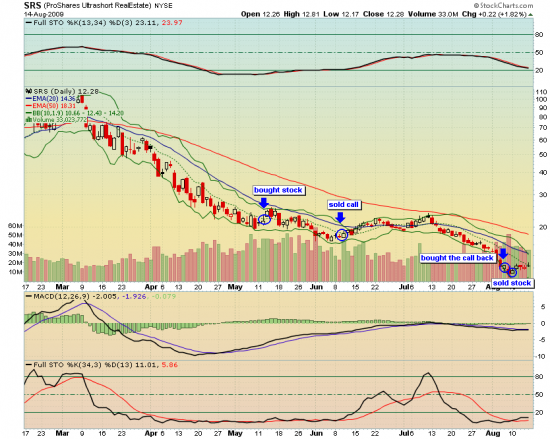

In May, I bought 100 shares of SRS at $21.65. Got greedy and waited for a big up day – which never materialized – to sell a call. I got impatient watching SRS tank day after day and finally on June 11th sold a JAN 2010 $18 call for $5.20.

Why so deep in the money? Because it’s a well-known fact that these ETFs decay. I figured there’s a good chance SRS would go below $15 and I could buy back the call at a good price. And maybe wait for a day when SRS goes up again and sell another call.

Since the call was so far out, it didn’t decay fast enough, had lots of time value in it. And since I sold it after the stock dropped, I didn’t get a very good premium for the option.

Ok, so long story short, I bought back the call for $2 and sold SRS @ $12.88, my net P&L on this trade was ($589).

What went wrong?

– bought an inverse double ETF and held

– sold the call on a dip, didn’t get a good premium

– sold a too far out call, so it didn’t decay fast enough

If it wasn’t an inverse Ultra ETF but a stock that tanked 80% (like many banks did last year) it would work out pretty much the same – the call wouldn’t have protected against that big of a loss.

There are other considerations to keep in mind. If you’re writing a call on a volatile stock, you may want to get out in premarket some day but won’t be able to until regular trading hours because you’d have to buy back the call first, before selling the stock.

I must say this was my worst experience ever with a covered call, all previous ones worked out okay. The lesson here is that this seemingly “can’t lose” strategy can yield horrible results if done wrong.

You didn’t check the volatility at that moment and blah, blah, blah… used very, but very

long-term(time-overvaluated and such ITM) option for you short-term strategy…